Silicon Valley Bank was founded in 1983 and has been a key supporter of startup projects in various fields, including space, robotics, artificial intelligence, medical technology, and cryptocurrencies, by investing in and operating in these areas.

What is the reason for the bankruptcy of this bank?

The central bank of the United States, also known as the Federal Reserve, began raising interest rates a year ago in an effort to combat inflation rates. However, the pace of these interest rate hikes was so rapid that it outpaced the growth rate of technology companies’ stock prices, particularly those benefiting from the “Silicon Valley” trend.

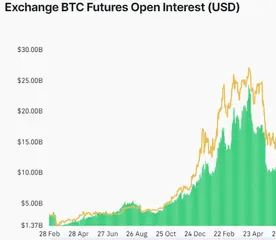

The increased interest rates also resulted in a reduction of the value of long-term bonds that banks such as Silicon Valley had purchased during the period of very low interest rates. While the yield on recently released 10-year bonds by the US Treasury reached 3.9%, only 1.79% of Silicon Valley’s $21 billion bond portfolio earned a profit.

Additionally, high-risk investments took a downturn, which caused startups to become more cautious about how they used their capital and deposits in Silicon Valley. As a result, the bank faced mounting losses from its bond portfolio, and the speed of customer withdrawals from their accounts and deposits, much of which had been spent on bond purchases, continued to increase.

To maintain its balance sheet, Silicon Valley announced on Thursday that it had to sell some of its securities and also intends to sell $2.25 billion of other shares. Investment firms became concerned and increased their withdrawals from this bank. The fall in the bank’s shares on Friday raised concerns about a repeat of the 2008 financial crisis, causing the shares of other banks to also decline.

Trading in Silicon Valley stocks was suspended on Friday, and the senior management’s efforts to quickly raise capital or find a buyer proved unsuccessful. Thus, the California State Banking Regulations quickly intervened and placed the bank under the supervision of a government-appointed trustee to ensure the stability of its operations and to protect the interests of its depositors.

The impact of SVB bank crisis on financial markets.

After the news of this bank’s bankruptcy was released, initially all bank stocks faced a decline. Additionally, the price of gold increased sharply, while the dollar faced a lot of selling pressure. However, many traders are keeping an eye on today’s closed-door session of the Federal Reserve, and the outcome of this session is expected to be very important. But predictions suggest that the Federal Reserve will currently turn a blind eye to interest rate hikes.

Furthermore, the collapse of SVB Bank caused a drop in the value of crypto lending platforms and stablecoins such as DAI and USDC. However, gradually these stablecoins regained their value, and with the start of the Bitcoin market and other cryptocurrencies, they have gained bullish momentum due to today’s statement by the Federal Reserve.

We will title the following statements of influential individuals regarding this incident:

The US Department of the Treasury and the Federal Reserve said in a joint statement regarding the support program for Silicon Valley Bank (SVB): “Decisive action is being taken to protect the US economy by strengthening public confidence in our banking system.”

🔹No harm or damage from the situation of Silicon Bank will be borne by taxpayers.

🔹Shareholders and some unsecured creditors will not be supported.

🔹The Federal Reserve Board announced on Monday that it will provide additional funds to eligible deposit institutions to ensure that banks have the ability to meet the needs of all their depositors.

🔹The banking system remains flexible and based on a strong foundation.

🔹Any harm or damage to the bank will be compensated by the Deposit Insurance Fund to support uninsured depositors, subject to special bank evaluations.

🔹To provide liquidity to US deposit institutions, each Federal Reserve bank pre-pays qualified borrowers and takes various types of securities as collateral.

🔹The Treasury Department will provide $25 billion from the Exchange Stabilization Fund to Federal Reserve banks to protect credits related to the banking finance program.

🔹Today’s actions demonstrate the United States’ commitment to taking “necessary steps” to ensure the safety of depositors’ savings.

🔹Eligible collateral includes any collateral that can be purchased by Federal Reserve banks in open market operations.

🔹The prepayment program can be requested at least until March 11, 2024.

Hirokazu Matsuno, the Senior Cabinet Secretary of Japan, said that they do not see a significant impact of SVB’s consequences on Japanese financial companies.

British Chancellor: Customers’ deposits at SVB are protected and taxpayers’ capital is not involved in it.

Bank of England: The overall banking system in the UK is still secure, healthy, and adequately capitalized.

According to 36Kr, almost all Chinese tech startups that received pre-Series B investments from US dollars first opened accounts at Silicon Valley Bank. There may be hundreds of startups in China that have hundreds of thousands or millions of their dollars held in SVB accounts.

Following recent events, Signature Bank was shut down yesterday by the Federal Reserve. The Federal Reserve cited the risks posed by Signature’s situation and stated that the decision was made to protect the US economy. Signature Bank is one of the most important banks in the cryptocurrency space, with various companies such as Coinbase, Celsius, and Paxos partnering with it and having deposits with it. However, Tether denied rumors of holding a portion of its reserves in the bank.

Earlier Monday, Joe Biden talked about a plan to protect depositors at Silicon Bank (SVB), which would prevent taxpayer capital from being put at risk.