Bankruptcies of Silicon Valley Bank and the closure of Signature Bank have caused a great turmoil in the market. It seems that major investors are pulling their capital out of the dollar and taking it to other markets such as Bitcoin, gold, and stocks. Below, we see the gold and Bitcoin indices and discuss some of the controversies surrounding this event.

As we indicated in the image with white color, many investors have turned to gold as a safe haven due to the fear of an economic recession, and this demand has caused gold to suddenly reach the channel of 1900 with significant growth. It seems that until the approach of the US government and central bank is not determined, gold will still be a safe haven for investors.

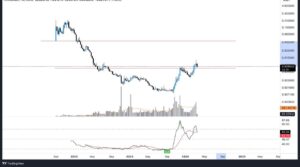

As it is evident, the market has realized that the Federal Reserve may put a halt on the interest rate hike, so buyers have taken action, and Bitcoin has managed to reach the important range of 24,500 once again.

We will continue to discuss the actions taken by officials and the controversies surrounding this economic disaster:

Traders priced in less than a 0.14% chance of a Federal Reserve rate hike next week, which could be positive for Bitcoin and gold and could cause these indices to have an upward trend in the short term.

After the bankruptcy of SVB, traders are predicting with a 54% likelihood that the Federal Reserve will halt the interest rate hike on March 22nd. There is also a 46% chance of a 0.25% interest rate increase.

Stournaras, a member of the European Central Bank, said, “I do not see any impact of Silicon Bank’s bankruptcy on the banks of the eurozone.”

Ulrich Leuchtman, Head of Research, emphasizes that the US dollar could quickly lose its safe haven status. Expectations for the European Central Bank are shifting towards a more moderate approach, but to a much lesser extent than the Federal Reserve.

🔹The likelihood of the Federal Reserve raising interest rates by another 0.5% is much lower because the policy implemented so far has created considerable stress.

🔹Not only should expectations for the Federal Reserve now be widely reconsidered towards a downward trend, but the very cautious policy of the European Central Bank seems much smarter. There is still more time for market participants to adjust.»

🔹Ultimately, the dollar may lose its safe haven status, which it recently enjoyed against the euro, as an asset.

Trump: US heading towards another major recession.

🔹 Following the shutdown of the second-largest bank in the US, Trump blamed Biden for the country’s economic woes and predicted a new major recession.

🔹 Trump wrote: With what’s happening to our economy and proposals for the biggest and most foolish tax increase, Biden will be known as Herbert Hoover (US president in the 1929-1933 era) of modern times.

🔹 We will have a much bigger and more powerful recession than in 1929. As an indicator, banks have started to collapse.