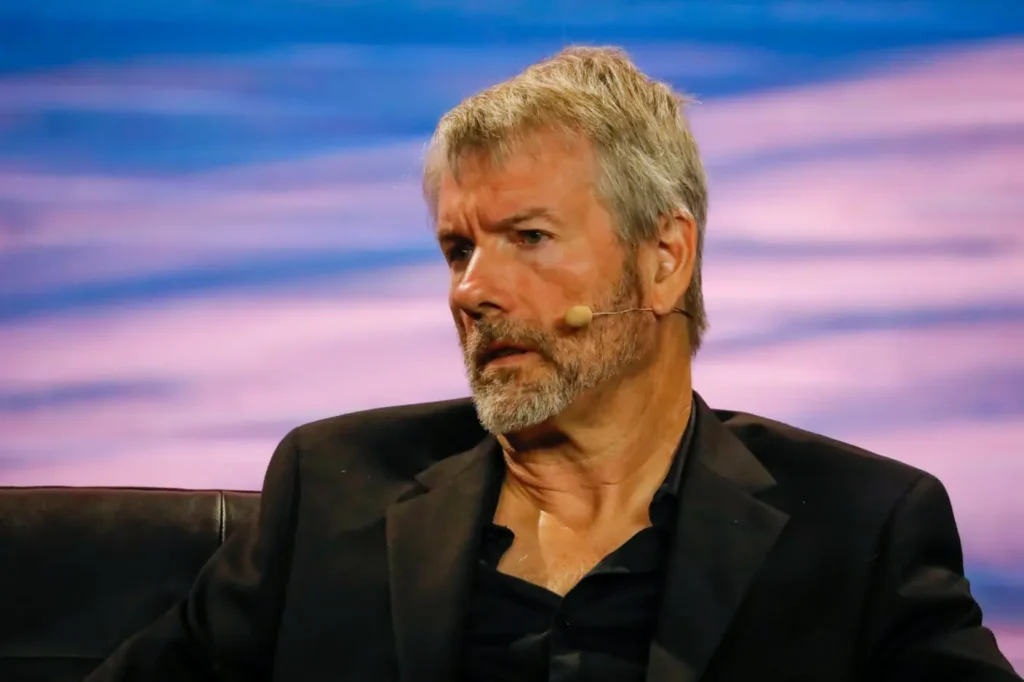

In a recent interview with Bloomberg TV, Michael Saylor, CEO of MicroStrategy (MSTR), revealed his firm’s steadfast commitment to holding onto its Bitcoin (BTC) reserves, emphasising the transformative potential of digital assets and asserting Bitcoin as the ultimate exit strategy for investors.

Saylor highlighted the significance of spot Exchange-Traded Funds (ETFs) as a catalyst for institutional capital inflow into the Bitcoin ecosystem. According to him, ETFs are facilitating a massive shift of capital from traditional analog assets to the digital economy, underscoring Bitcoin’s role in this digital transformation.

MicroStrategy’s Bitcoin holdings, totaling 190,000 BTC as of January, were acquired at an average price of $31,224 per coin. With Bitcoin now trading around $52,000, the company’s holdings are valued at approximately $10 billion, representing a staggering $4 billion profit. Despite this substantial appreciation, Saylor remains unwavering in his decision not to sell.

Saylor views Bitcoin as a superior asset class compared to traditional investments like gold, real estate, and the S&P index. He said that Bitcoin’s technical superiority will continue to attract capital away from these established assets into the crypto market. Consequently, MicroStrategy sees no reason to divest its Bitcoin holdings in favour of lesser-performing assets.

MicroStrategy’s strategic shift towards Bitcoin began in August 2020, and the company has since continued to accumulate Bitcoin, demonstrating its long-term confidence in the cryptocurrency. With the rebranding as a “bitcoin development company” in its fourth-quarter earnings report, MicroStrategy solidifies its commitment to Bitcoin as a core component of its corporate strategy.

Michael Saylor’s strong commitment to keeping Bitcoin shows that MicroStrategy believes in digital money’s future. They think Bitcoin can do better than regular investments. As more big organisations start using Bitcoin, MicroStrategy is leading the way in the changing money world.