MicroStrategy(MSTR), a Bitcoin software manufacturer company, is planning to add more bitcoins to its already large number of 205,000 bitcoins (BTC) after a $525m convertible debt offering.

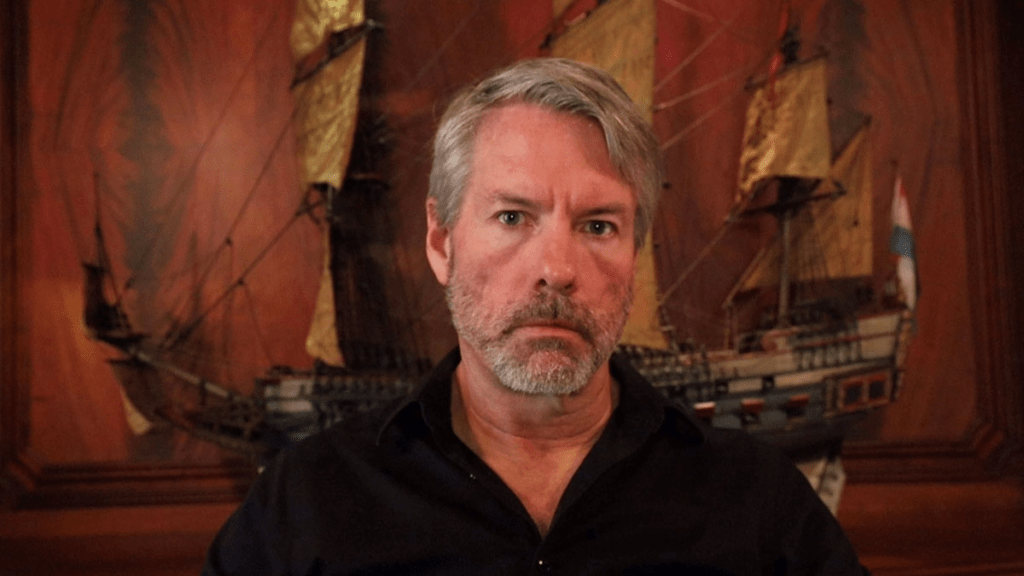

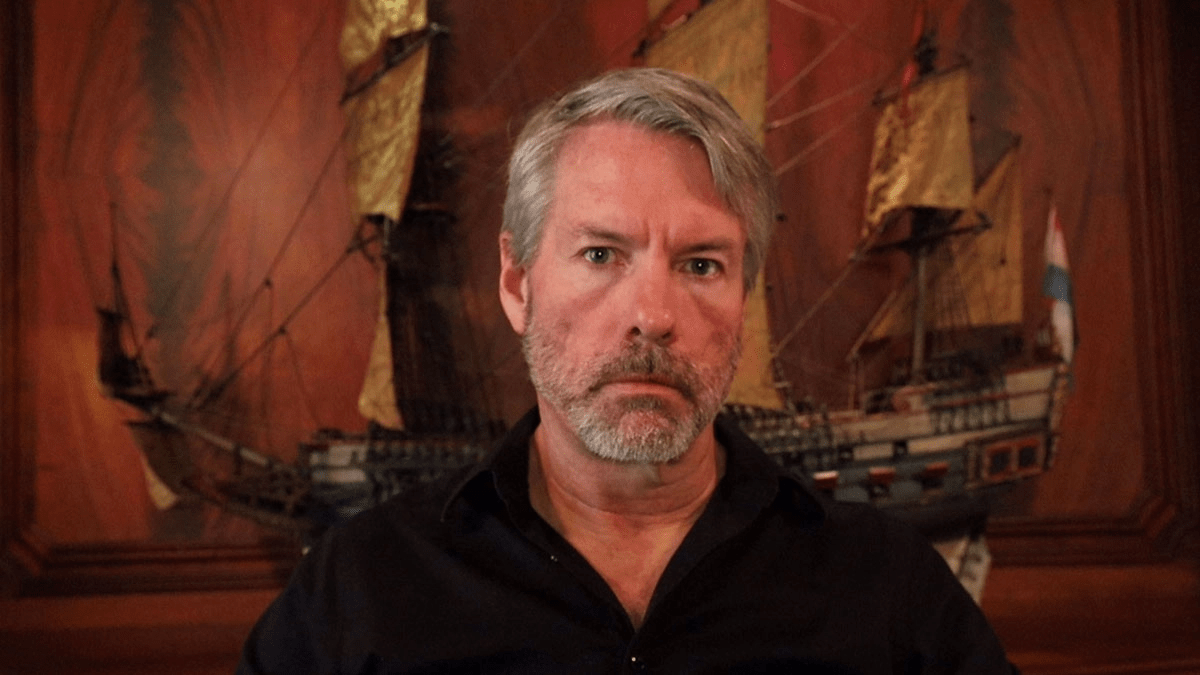

MicroStrategy Executive Director Michael Saylor

The private sale originally meant for $500 million was scaled up and there was an option offered to buyers who wanted up to an additional $78.5 million worth of notes. This means that total earnings will probably be approximately $600m.

Read more about Bitcoin/TetherUS

This capital raise has been announced days after a similar structured $800 million offering. The proceeds from the previous offer were used by the firm to purchase an extra 12,000 bitcoins.

The new convertible senior notes are expected to bear interest at a rate of 0.875% p.a., slightly higher than the rate on a similar $800mn debt sale just a few days back which stood at 0.625%. The conversion price for this second set of notes was fixed at $2,327.31 per share indicating an approximately forty percent premium over MSTR’s average Thursday price of $1662.20.

MSTR shares slumped by 5% on Thursday due to bitcoin tumbling below $70k in value. In premarket trading, shares fell by 3.3% as bitcoin continues slipping lower with it presently changing hands at around $67,700.