Bitcoin has climbed in rank among valuable assets by surpassing silver to claim the eighth position globally.

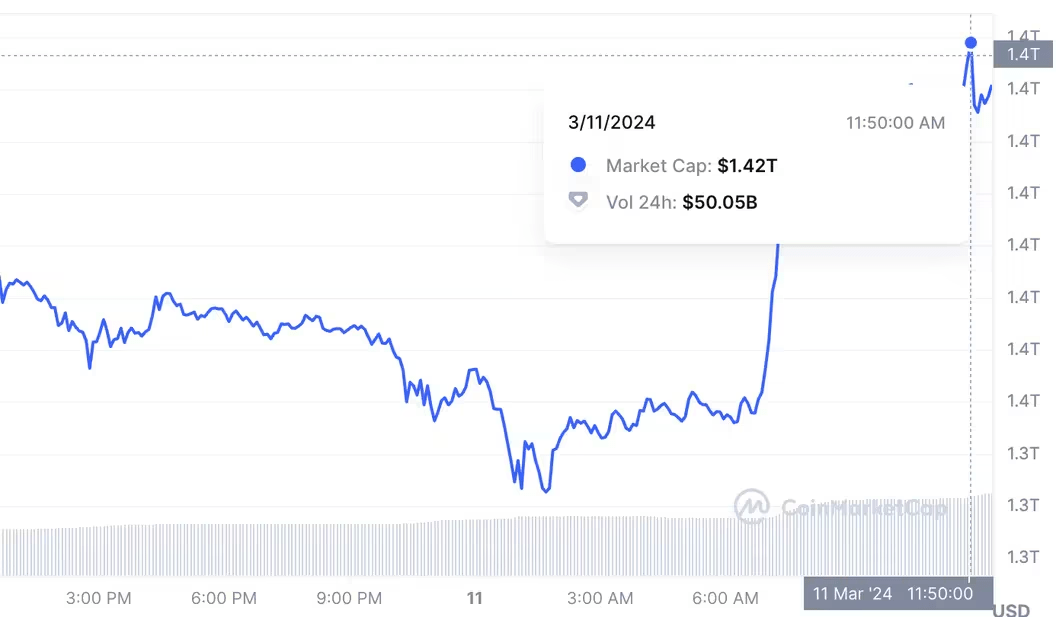

Bitcoin in the second category of a digital type of money has pushed past the value of silver and is now the valuable property globally. Bitcoin for the second time in just a few days has managed to reach a markedly new high point and has passed $72,000. Such a rise in its price brought xBTC price to a humongous $1.42 trillion.

What is more, this is just ahead of the silver’s value of $1.387 trillion as per the Company Market Cap report.

When talking about the bullish trend of Bitcoin, crossing the market value of $1.2 trillion of Meta Platforms (formerly Facebook) was the beginning of it. Now Bitcoin is targeting the market cap of Alphabet. Alphabet is the Google’s parent company and is the seventh largest company.

How much is Alphabet currently valued at now?

It is about 1.7 trillion dollars. A part of those Bitcoin proponents are even convinced that it one day will be worth more than is today, which is the most expensive product with a $14.7 trillion market cap. To fulfill such purpose of payments, BTC would need to become more than ten times more expensive to hit a price of nearly $720,000 per token.

Earlier in this significant bull run, Bitcoin exceeded the market capitalization of Meta (previously known as Facebook), which currently stands at $1.2 trillion. Bitcoin is now targeting the world’s seventh most valuable asset, Google’s parent company Alphabet, which is currently valued at nearly $1.7 trillion.

Some bitcoin bulls believe Bitcoin could eventually overtake the most valuable asset, gold, with its market cap of $14.7 trillion. Achieving this would require Bitcoin’s value to increase by more than ten times, reaching over $720,000 per token. In a morning update, Matteo Greco, a research analyst at Fineqia Capital, stated that :

“The strong price movement is still being driven by the positive momentum of BTC Spot ETFs,”

On the same side, The London Stock Exchange has declared already that considering applications for the bitcoin and ether exchange-traded notes (ETNs) is in line with its policy.