The excitement in the market is back, with a renewed interest in bitcoin similar to what we saw in 2021. People are showing interest in options for bitcoin that could give them a payout if the cryptocurrency’s price triples soon.

On Friday, a bitcoin call option was listed on Deribit with a strike price of $200,000. This option had a total open interest of over $20 million. This strike price is nearly three times higher than the current market rate of bitcoin, which is around $67,000.

Out of the total amount, $14.6 million is invested in the call option with a strike price of $200,000, which expires on December 27. The remaining amount is focused on call options expiring in June and September, according to data from Deribit Metrics.

In theory, purchasing a deep out-of-the-money (OTM) call option at the $200,000 strike price, expiring on December 31, is essentially a wager that the cryptocurrency will finish the year above that threshold.

Call options grant investors the privilege to purchase the underlying asset at a predetermined price at a future date. By acquiring a call option, an investor is essentially expressing optimism about the market.

The term “notional open interest” refers to the total value, in U.S. dollars, tied up in active options contracts at a specific moment. On Deribit, the leading cryptocurrency options exchange, each option contract represents ownership of one bitcoin.

The $200,000 strike call option became popular when bitcoin last traded above $60,000 in 2021.

The recent attention on the deep OTM strike aligns with the general agreement that Bitcoin’s upcoming halving, which will reduce its supply, will make the balance between supply and demand even more favourable for buyers. This could eventually drive prices up to over $100,000.

Recently, the ratio between supply and demand for Bitcoin reached 1:10, largely because Wall Street has started to accept exchange-traded funds (ETFs) based on Bitcoin in the United States.

Bitcoin reached new all-time highs above $69,000 earlier this week, but it’s currently trading around $67,000. This represents a gain of 59.7% since the beginning of the year.

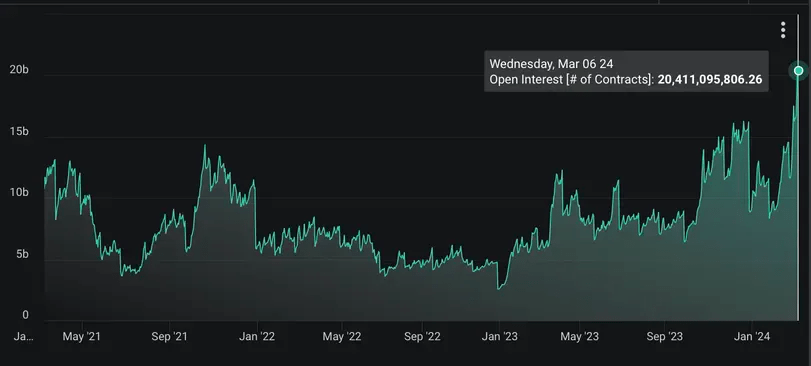

The recent rise in Bitcoin’s price has led to increased activity in the options market. On Deribit, the total open interest in Bitcoin options has reached a new record of $20.4 billion, exceeding the previous peak of $14.36 billion in October 2021.

Open interest has hit a new record high. (Deribit)

Deep OTM calls are less expensive compared to options with strikes closer to or below the current market price. Because of this, buying deep OTM calls is often likened to buying lottery tickets.

The potential downside risk is restricted to the premium paid for the option. However, there’s significant upside potential if the market exceeds the strike price before the option expires.