What is scalping?

Scalping is a trading approach characterised by its rapid pace and focus on exploiting small price movements for quick profits. It’s a favoured method among traders seeking immediate engagement and returns.

In this article, we explore three top-tier 1-minute scalping strategies: Heikin-Ashi Pullback, RSI Extremes, and Stochastic Oscillator Quick Signal, offering insights into their intricacies and practical applications within the trading landscape.

Understanding Scalping

Scalping involves seizing fleeting price changes in financial markets. Practitioners of this strategy aim to accumulate several pips – minimal price increments – from each trade, often executing numerous trades within a single day. Given the high frequency of transactions, managing transaction costs and executing trades swiftly are paramount considerations.

Successful implementation of this strategy demands a profound comprehension of market dynamics, adept real-time data analysis, and a disciplined approach to risk management. Although commonly associated with forex markets, scalping techniques are adaptable to stocks, commodities, and various other financial instruments.

To witness these ultra-fast scalping strategies in action, consider utilising FXOpen’s complementary TickTrader platform, where you’ll find all the discussed tools readily available for exploration and implementation.

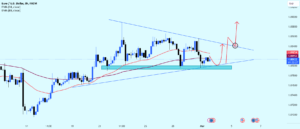

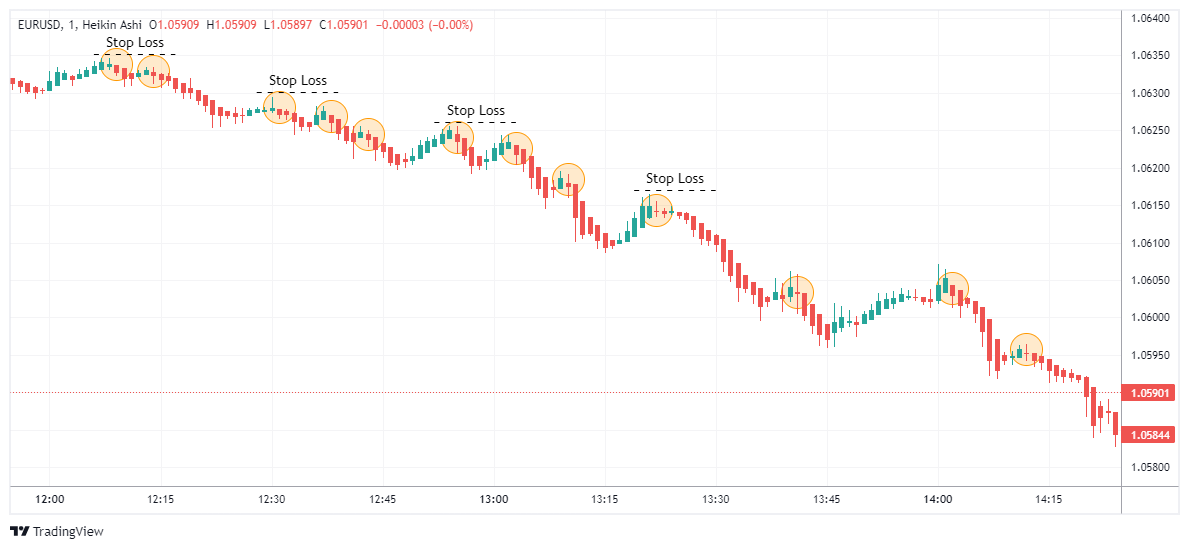

Heikin-Ashi Pullback

The Heikin-Ashi Pullback strategy is centred around detecting retracements within established trends using Heikin-Ashi candlestick charts. This approach enables traders to identify moments when the trend temporarily reverses, offering an opportunity to enter the market with the expectation that the dominant trend will continue.

Entry:

For entry points, traders monitor trends characterised by consecutive Heikin-Ashi candles of the same colour. In a bearish trend marked by red candles, traders anticipate pullbacks signalled by the transition to green candles. Typically, entry occurs when a red Heikin-Ashi candle follows one or more green pullback candles. Conversely, in bullish trends with green candles, traders await the shift to red candles, indicating a pullback.

Entry is typically triggered by the appearance of a green Heikin-Ashi candle after one or more red pullback candles. This strategy allows traders to capitalise on temporary reversals within established trends.

Stop Loss:

A common practice is to place a stop-loss at the high or low of the entry candle. Alternatively, traders may opt to set the stop-loss above or below a nearby swing point for added security.

Take Profit:

Traders often close their position when a single candle of the opposite colour emerges.

Some traders choose to exit when the trend reaches a predetermined resistance or support level.

The Heikin-Ashi Pullback strategy utilises the inherent rhythm of market movements. By entering trades during pullbacks, traders aim to exploit the market’s inclination to return to its dominant trend. This rapid scalping method provides a systematic approach for pinpointing probable entry and exit positions, establishing its popularity among scalpers.

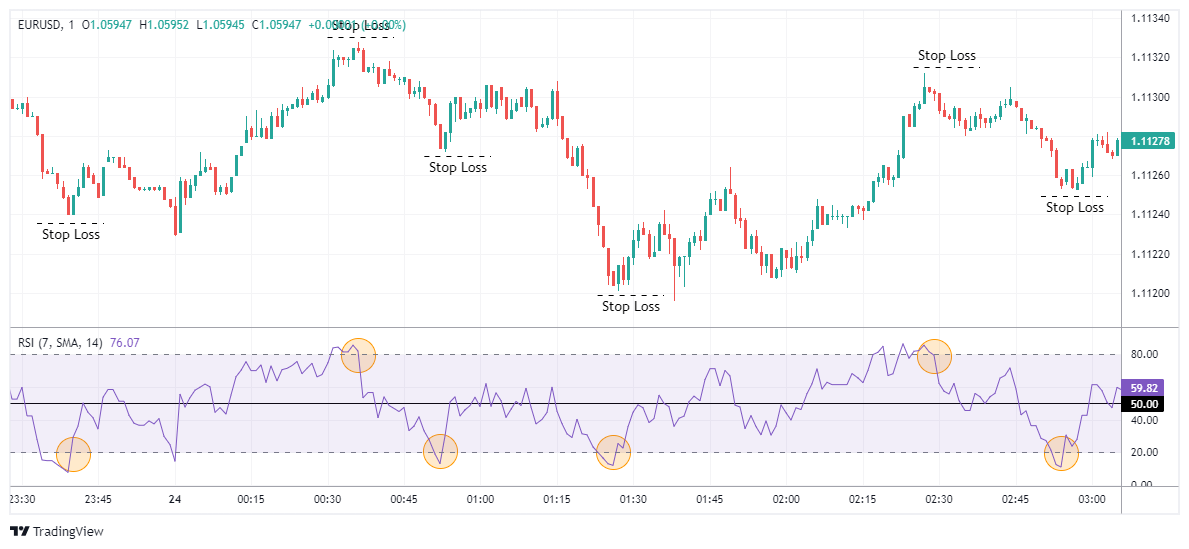

RSI Extremes strategy

The RSI Extremes strategy is often lauded as one of the premier scalping techniques, particularly when implemented in the context of a 1-minute forex trading strategy. It relies on the Relative Strength Index (RSI) with a period setting of 7 to pinpoint potential reversals occurring at extreme overbought or oversold levels.

Image credit:Tradingview.com

Entry:

The RSI Extremes strategy relies on a 7-period RSI applied to a 1-minute chart for its effectiveness. Traders seek entry points when the RSI crosses above 80 and subsequently drops below, indicating a potential short position.

Conversely, opportunities for long positions arise when the RSI falls below 20 and then rises back above. These signals enable traders to capitalise on short-lived market reversals, aligning their trades with prevailing momentum.

Stop-loss:

For stop-loss placement, traders commonly opt to position it a few pips above or below the entry candle. Alternatively, they may choose to set the stop-loss beyond a nearby swing high or low to enhance risk management measures.

Take profit:

When determining take-profit levels, traders typically target key support or resistance areas. Additionally, exiting the trade as the RSI approaches the 50-level, signalling a waning momentum, presents another viable option.

This structured approach enables traders to manage their trades effectively within the context of market extremes identified by the RSI.

Stochastic Oscillator Quick Signal

The Stochastic Oscillator Quick Signal is a straightforward forex scalping approach tailored to capture short-term price movements efficiently. Leveraging the Stochastic Oscillator, traders can pinpoint overbought and oversold scenarios to execute timely entries and exits.

Image credit:Tradingview.com

Entry

Entry points are typically identified by applying a Stochastic Oscillator with settings (14, 3, 3) to a 1-minute chart. Traders often consider entering positions when the %K line (blue) crosses above the %D line (orange), both below 20, signalling a potential long position.

Stop-loss

For risk management, stop-loss placement usually involves positioning it a few pips from the entry point or setting it beyond a nearby swing high or low to enhance safety measures.

Take-profit

When determining take-profit levels, traders frequently opt to exit the trade as the Stochastic Oscillator reaches the opposite extreme. Alternatively, closing the position upon detecting a divergence between the price and the oscillator presents another viable approach.

The Stochastic indicator serves as a pivotal component in this strategy, specifically tailored for 1-minute scalping endeavours. It functions adeptly in identifying swift shifts in market momentum, enabling traders to capitalise on fleeting overbought or oversold conditions for swift profit generation.

Conclusion

To conclude, each strategy discussed presents a distinct approach to market engagement, offering avenues to uncover profit potentials. However, it’s essential to customise these strategies to align with one’s individual trading methodology.

Best wishes for your trading endeavours!

Disclaimer: Please note that the opinions expressed in this article solely represent those of the entities operating under the FXOpen brand. It should not be interpreted as an offer, solicitation, or recommendation regarding products and services provided by the aforementioned entities, nor should it be construed as financial advice.