A few days ago, the Commodity Futures Trading Commission (CFTC) announced that two cryptocurrencies, BUSD and Litecoin, are considered commodities, and also stated that Binance has engaged in some illegal activities. Overall, the commission has presented seven allegations against Binance, including:

- Binance likely knew it was facilitating illegal transactions and did not care.

- The IP address controls of Binance were not effective in preventing customers from accessing “restricted jurisdictions,” including the United States.

- Binance has a “VIP” program for large accounts that provides faster transactions and immediate notification to law enforcement if information or wallet checks are requested by authorities.

- Regulators have not been convinced that Binаnсе US is separate from Binance.

- Binance maintained almost 300 house accounts (a type of account with higher priority that is managed by the main office or executive and replaces a traditional seller) that were traded on the platform and were “directly or indirectly owned by Zhao” along with accounts of other entities under his control. Apparently, they were used to trade against customers and manipulate the market.

- CZ is the direct or indirect owner of all Binance corporate entities, which number more than 120, and they “answer to no one but themselves” and skimp on KYC and AML procedures for them.

After the announcement, $170 million immediately left the exchange. Additionally, as part of a potential settlement agreement, the CFTC may ask Binance to halt its operations in the United States.

The head of CFTC (Commodity Futures Trading Commission) also announced that a complaint against Binance is necessary. He emphasized the need for clearer laws and more authority for CFTC to protect US customers from fraud and deception.

But what impact will this have on Binance and the cryptocurrency market?

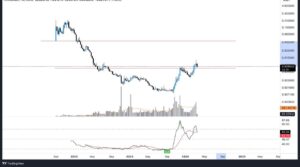

Just hours before the Binance lawsuit, almost $1.5 billion worth of crypto was withdrawn from Binance, Kraken, Coinbase, and Bitfinex, with more than half, or $850 million, taken out of Binance. However, it appears that Binance had anticipated these issues and had therefore relocated its headquarters to the United Arab Emirates to have a concentration in Asia and Africa, where regulations are less strict, in addition to being exempt from taxes. If the U.S. Futures Trading Commission can accuse and penalize Binance, the market may experience severe fear, and investors may start selling their assets. This could have a similar result to the downfall of FTX exchange. Nevertheless, Binance’s owner (CZ) has denied the allegations and called them baseless.

According to a reputable commercial analysis company, the CFTC case against Binance could lead to clearer laws and penalties that fall into one of three scenarios:

1) no penalties 2) controllable penalties 3) significant penalties.

The execution can take two paths: one is a short-term resolution that leads to a desirable outcome, and the other is a lengthy legal battle that can be bearish for the entire crypto market. Regardless, the short-term performance of price and fluctuations is uncertain. This complaint may exacerbate the digital asset banking system’s tightness. It can also lead to clearer guidelines and increased investor confidence in the long term, similar to the previous case of Bitmex, which led to a 700% increase in Bitcoin. Before the crypto market reaches another inflection point in its cycle, it must consider the consequences of this complaint.