The unstoppable rise of Bitcoin is causing the price of holding leveraged bullish bets to increase rapidly in perpetual futures trading. This creates a good opportunity for traders who don’t want to bet on the direction of the market to make profits through arbitrage.

On Tuesday, bitcoin soared to nearly $57,000, reaching its highest level since late 2021 and marking a year-to-date gain of 32%, according to data from CoinDesk. The broader cryptocurrency market, as represented by the CoinDesk 20 index, also experienced significant gains, trading nearly 6% higher.

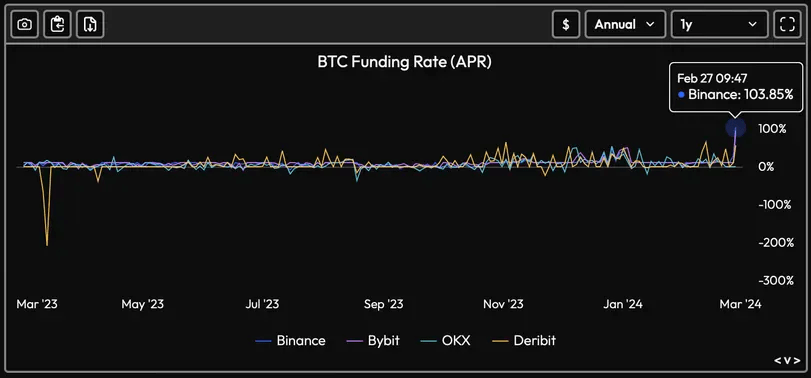

The annualised funding rate on Bitcoin perpetual futures, as reported by Velo Data and CoinGlass, has exceeded 100% for the first time in over a year on Finance. Similarly, Bybit and Deribit have seen rises in their funding rates to 95% and 56%, respectively.

A positive funding rate indicates that perpetuals are trading at a premium to spot prices, resulting in traders with long positions paying fees to those with short positions every eight hours.This rate reflects a bullish sentiment in the market or suggests that traders are heavily leaning towards bullish positions with leverage.

Markus Thielen, the founder of 10X Research, noted that the surging funding rates likely result from traders making optimistic bets, expecting sustained inflows into the U.S.-based spot ETFs.

Thielen pointed out the explosive growth in perpetual funding rates alongside a continuous rise in open interest, which now stands at $14.4 billion. He underscored that traders are growing more confident in the positive impact of the halving and anticipated ETF inflows on Bitcoin’s price, reinforcing their bullish outlook.

Bitcoin: Annualised perpetual funding rates (Velo Data)

Image credit:coindesk.com

Thielen noted that the surge in funding rates presents an appealing opportunity for non-directional traders or arbitrageurs. Arbitrage entails capitalising on price differences between two markets. With an elevated funding rate, perpetual futures are trading at a notable premium compared to the spot price.

“With the perpetual futures funding rates reaching elevated levels, crypto hedge funds are enjoying exceptionally wide arbitrage spreads. BTC and ETH are trading at spreads of 20% and 30%, or even higher, making this the ideal scenario for arbitrage books. In this market, both those who are outright long and those who are playing the perpetual spread stand to benefit. It’s a fantastic time to be involved in crypto!” Thielen stated.