Crypto bulls are raising doubts about the lasting nature of recent significant increases in alternative cryptocurrencies (altcoins), such as meme coins. They may look into the recent pattern in the spread between bitcoin and ether perpetual funding rates.

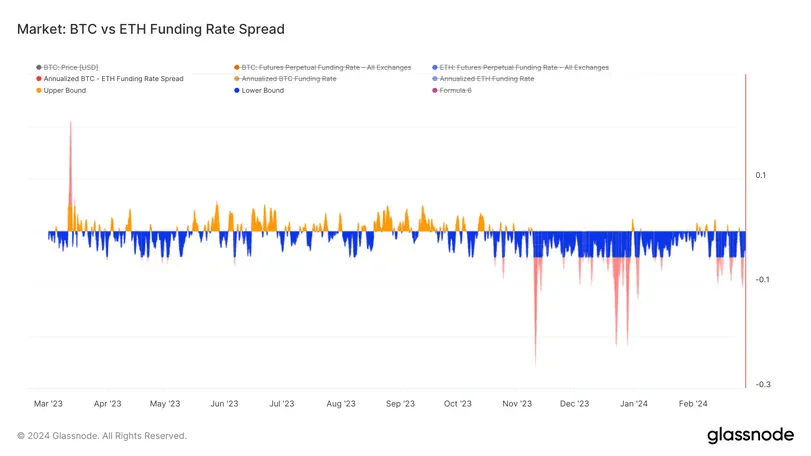

Recent data from Glassnode indicates that the difference between bitcoin and ether perpetual funding rates has sharply decreased, reaching an annualised level of -9%. This means that investors are now more willing to pay higher fees for bullish positions in the ether perpetual futures market compared to bitcoin.

This shift indicates a growing appetite for risk, as investors are putting more money into smaller and riskier altcoins, hoping for big profits.

Glassnode observed that the difference between BTC and ETH funding rates is growing, which marks a change from the more stable pattern seen before October 2023. Previously, the difference fluctuated between positive and negative levels.

Glassnode noted that since the October rally, funding rates for ETH have consistently been higher than those for BTC. This suggests that traders are increasingly willing to take on riskier speculation.

Bitcoin, known as the biggest cryptocurrency globally in terms of market value and with significant liquidity, is experiencing increasing mainstream adoption. On the other hand, Ether is a major altcoin leader and is considered relatively high beta.

The price and funding rate differences between Bitcoin and Ethereum markets indicate broader risk sentiment, similar to the role of the AUD/JPY pair in traditional markets.

Perpetuals, which lack an expiration date, utilises a funding rate mechanism to ensure their prices closely track spot prices. A positive funding rate indicates a bullish bias in leverage, with long position holders paying shorts to maintain their positions. Conversely, a negative rate indicates the opposite scenario.

Bitcoin-Ether Funding Rate Spread (Glassnode)

Throughout the initial nine months of 2023, the bitcoin-ether funding rate spread fluctuated within the range of -3% (lower bound) to +3% (upper bound). However, starting from October, there have been multiple instances of the spread briefly dipping below -3%, indicating a preference towards ether and the broader altcoin market.

The recent decline is related to the rise of price in ether and other altcoins. This helps to drive the crypto market capitalization upwards.

Bitcoin’s dominance rate, typically fluctuating between 51% and 54% since early January has remained relatively stable. The total crypto market capitalization has risen from around $1.7 trillion to $2.2 trillion over this period.